What Would a Recession Mean for the Housing Market?

As the possibility of a recession becomes more prevalent, many people are concerned that they should postpone their plans to become homeowners.

Here’s a look at historical data to show what happened in real estate during previous recessions to help prove why you shouldn’t be afraid of what a recession would mean for the housing market today.

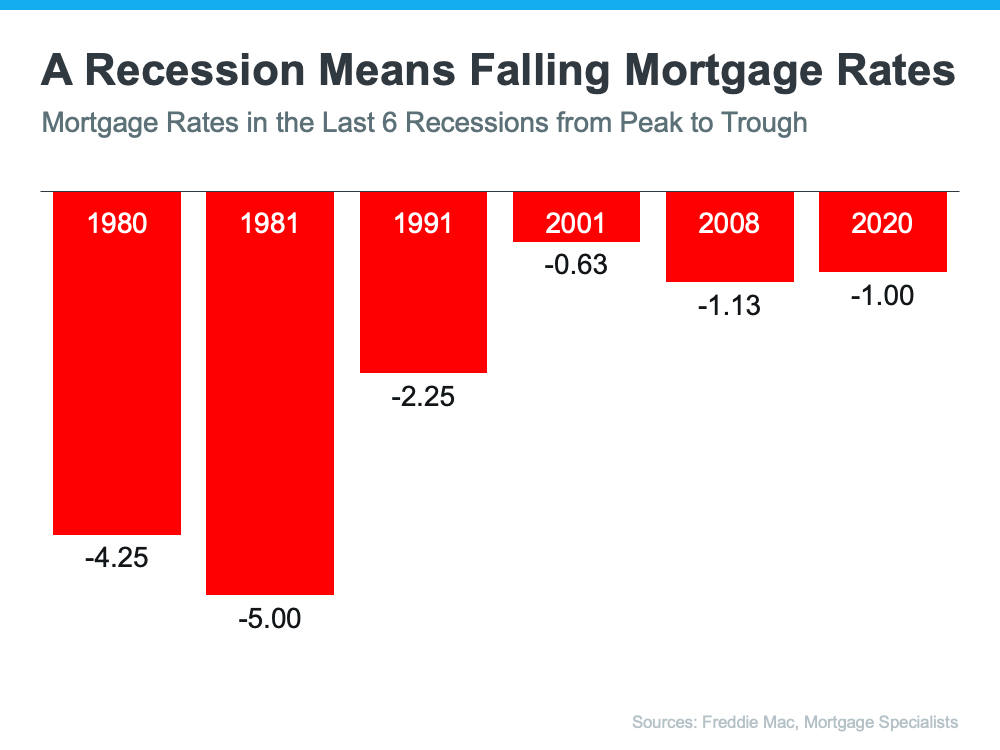

A Recession Doesn’t Mean Falling Home Prices

It helps to look at historical data to demonstrate that home prices don't always decrease during recessions. Home prices increased in four of the most recent six recessions, as shown in the graph below, which shows the recessions going all the way back to 1980. Therefore, historically, a slowing economy has not resulted in a decline in property values.

The majority of individuals believe that another recession will mirror what occurred during the housing crisis of 2008 (the greater of the two red bands in the graph above). However, a crash in the property market is not imminent. Today's principles are considerably different from those of 2008. So don't assume that we are going in the same direction.

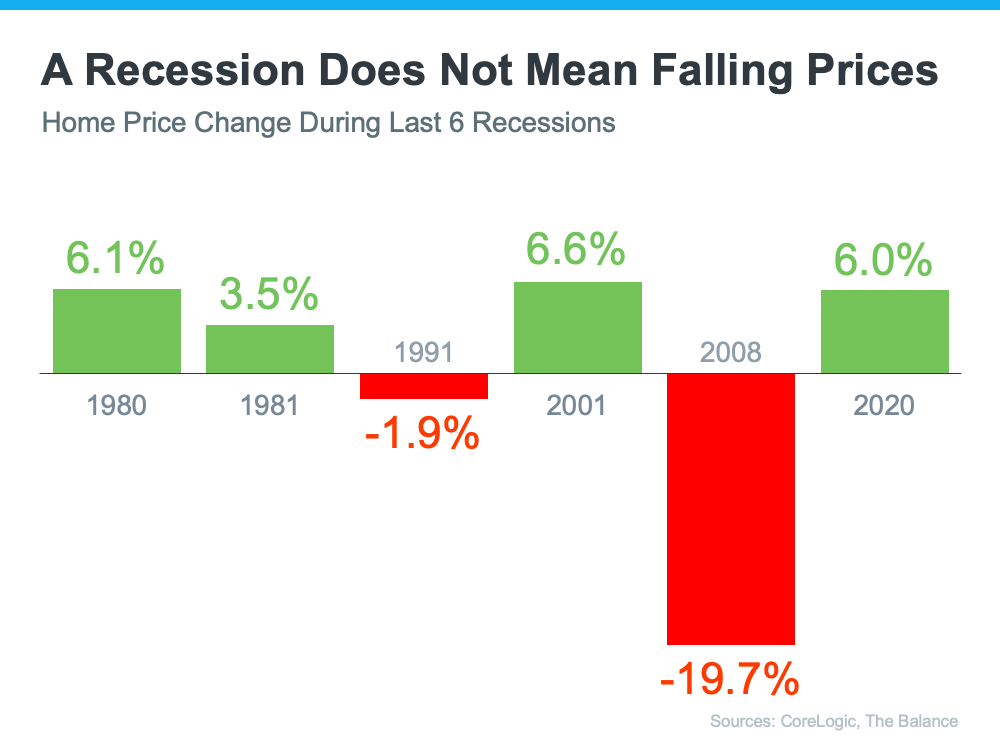

A Recession Means Falling Mortgage Rates

Research also helps paint the picture of how a recession could impact the cost of financing a home. As the chart below shows, historically, each time the economy slowed down, mortgage rates decreased.

Fortune explains that mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

And while history doesn’t always repeat itself, we can learn from and find comfort in the historical data.