What Past Recessions Tell Us About the Housing Market

Whether you pay close attention to the economy or not, there's a good likelihood that you've heard rumblings about an impending recession. Since there are many different elements that affect economic conditions, rather than going into detail about each one, let's rely on the opinions of experts and what the past has taught us to predict the future. According to Bankrate's Chief Financial Analyst, Greg McBride:

“Two-in-three economists are forecasting a recession in 2023 . . .”

You might be wondering what a recession might imply for the home market as talk of one increases. Here is a historical analysis of real estate activity throughout previous recessions to demonstrate why you shouldn't be concerned about what a current recession would mean for the home market.

A Recession Doesn’t Mean Falling Home Prices

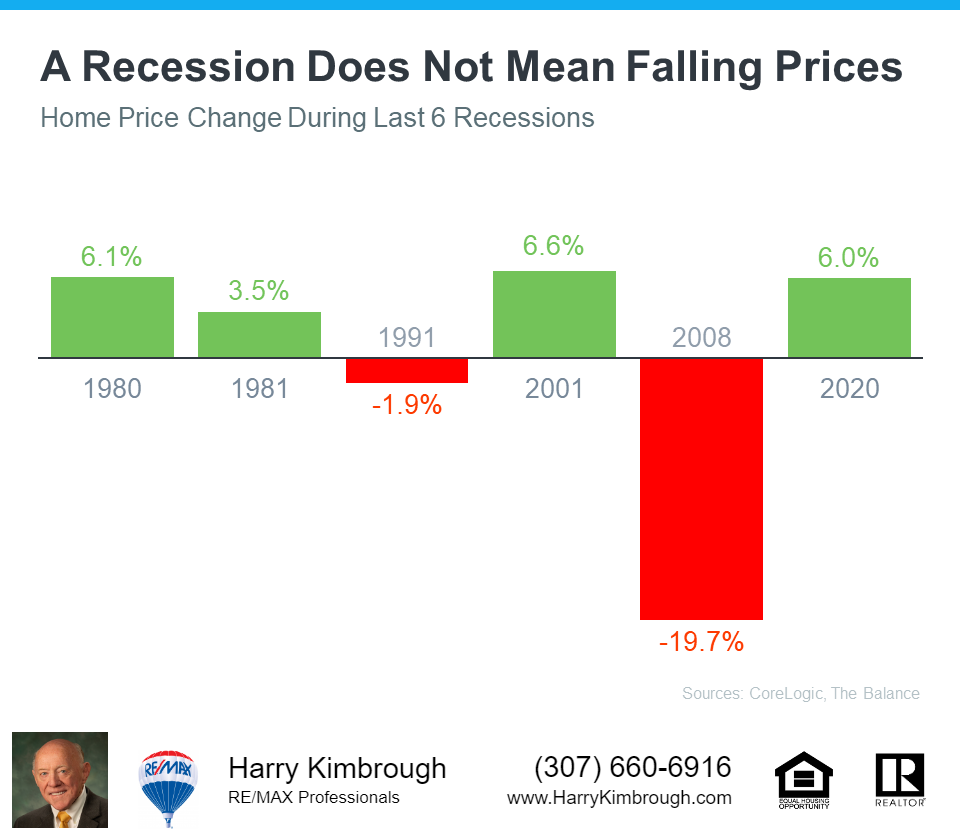

It helps to look at historical data to demonstrate that home prices don't always decrease during recessions. Home prices increased in four of the most recent six recessions, as shown in the graph below, which examines downturns dating all the way back to 1980. Therefore, historically speaking, home values don't necessarily decrease when the economy weakens.

The majority of individuals believe that another recession would result in a replay of what occurred to housing in the housing crisis of 2008 (the greater of the two red bands in the graph above). But because of different market fundamentals than in 2008, the housing market today is not about to fall. Experts predict that home values will fluctuate by market and may rise or fall depending on the neighborhood. However, the average of their projections for 2023 indicates that prices will be net neutral nationwide rather than dropping sharply as they did in 2008.

A Recession Means Falling Mortgage Rates

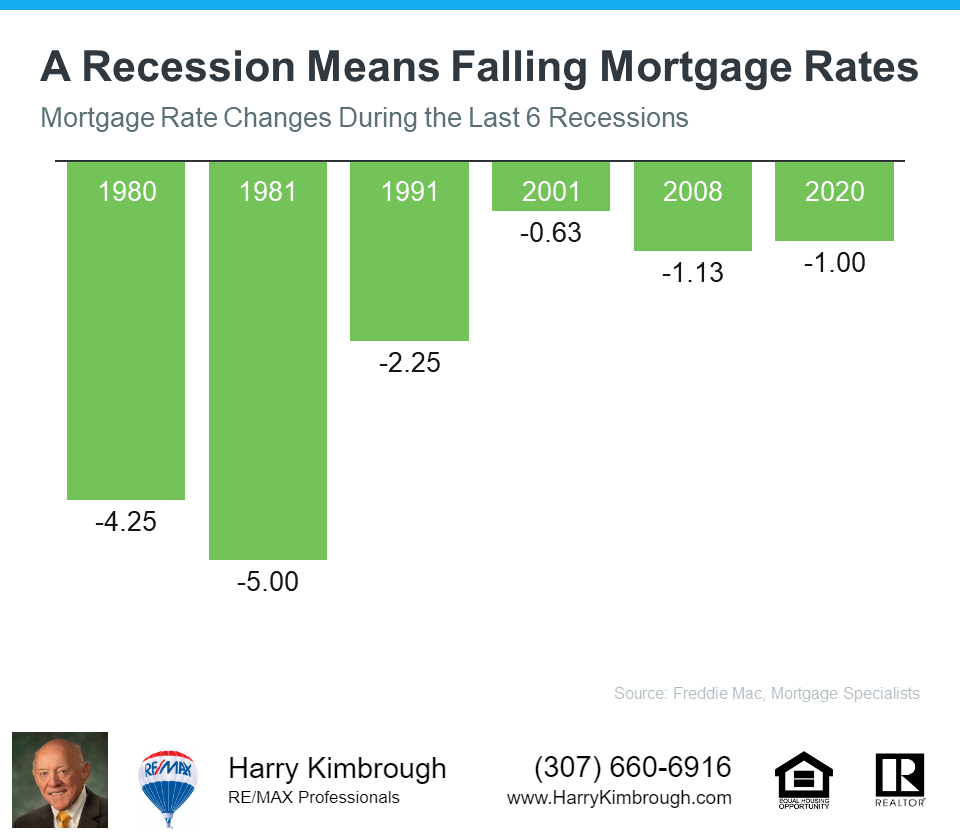

Research also contributes to the understanding of how a recession might affect the cost of mortgage finance. According to the graph below, historically, mortgage rates fell whenever the economy slowed down.

Fortune explains mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

Mortgage rates are predicted by market analysts to stabilize in 2023 below their peak from last year. This is due to the fact that mortgage rates typically react to inflation. Additionally, early indications suggest that inflation is beginning to decline. Rates might decrease a little bit further if inflation slows down some further, but the days of 3% are probably over.

The main lesson is that when it comes to housing, you shouldn't be concerned by the word recession. In fact, according to economists, a recession would be moderate and housing would be crucial to a swift economic recovery. According to KPMG's CEO Outlook for 2022:

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, with more than half expecting it to be mild and short.”

Bottom Line

Even while the past doesn't always repeat itself, we can still gain insight from it. Historical data shows that throughout the majority of recessions, home values increased and mortgage rates decreased.

Let's connect if you're considering buying or selling a house this year so you can get professional advise on what's going on in the housing market and what it implies for your homeownership aspirations.