If you've been following the housing market in recent years, you've probably heard about rising affordability issues. However, experts predict that the fundamental factors determining housing affordability will improve this year. CoreLogic's Executive, Deputy Chief Economist, Selma Hepp, explains:

“. . . with slowly improving affordability and a more optimistic economic outlook than previously believed, the housing market could show resilience in 2023.”

Housing prices, mortgage rates, and earnings are the three factors used to determine home affordability. Each one is examined in greater detail below.

1. Mortgage Rates

Mortgage rates rose above 7% last year, leading many purchasers to postpone their purchases. However, things are changing as interest rates begin to fall. According to George Ratiu, Senior Economist of realtor.com:

“Let’s celebrate some good news. . . . mortgage rates are down. With inflation showing a tangible slowdown, I do expect mortgage rates to follow suit in the months ahead.”

Even little changes in interest rates might have an influence on your purchasing power. This context is provided by Nadia Evangelou, Director of Forecasting for the National Association of Realtors (NAR):

“With a 6% rate instead of 7%, buyers pay about $2,700 less every year on their mortgage. As a result, owning a home becomes affordable to about 1.4 million more renters and 4.3 million more homeowners.”

If 7% interest rates put a halt to your homebuying ambitions last year, this could be the opportunity you've been waiting for. Work with a team of professionals who are up to date on mortgage rates and can provide you with the finest recommendations for the current market.

2. Home Prices

The second aspect to consider is housing prices. Home prices have been in the news recently because they surged during the pandemic. When discussing property prices in 2023, NAR Chief Economist Lawrence Yun says:

“After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.”

As a result, while prices in some markets are likely to remain steady this year, others may see tiny gains or slight reductions. It all depends on where you live. Reach out to a trustworthy real estate agent for insight into what's going on in your market and how prices are affecting affordability.

3. Wages

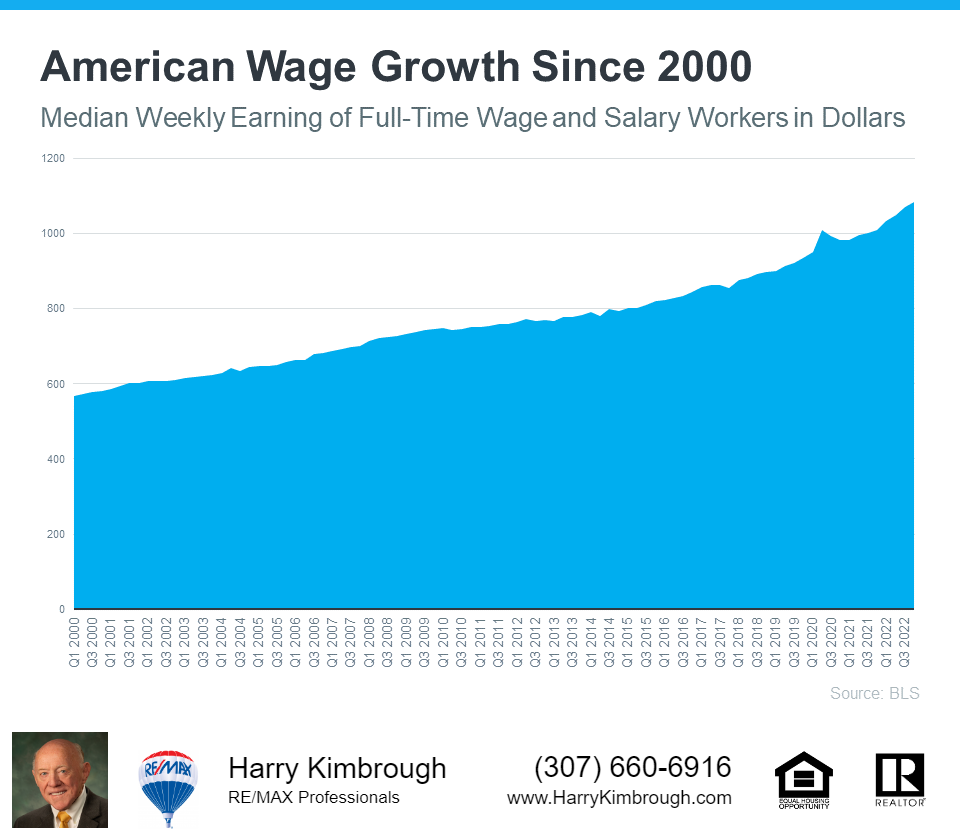

Wages are the final factor in the affordability equation. The graph below shows how salaries have increased over time using data from the Bureau of Labor Statistics (BLS):

When considering affordability, keep in mind that the big picture involves more than just mortgage rates and pricing. Wages must also be considered. As earnings have risen, many purchasers have found new opportunities in the market.

While affordability concerns will not be totally eliminated this year, based on current patterns and estimates, 2023 should provide some respite to purchasers who have faced increasing difficulties. According to Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA),

“Rates are expected to move lower for the year, and home price growth is expected to cool, both of which will help affordability challenges.”

Bottom Line

Let's talk if you have any questions. You'll also want to choose a reputable lender with whom you can discuss your financing possibilities. You might be closer to house ownership than you realize.