Two Questions Every Homebuyer Should Ask Themselves Right Now

Since the start of the year, monthly mortgage payments have increased significantly, which has caused an overheated housing market to calm down. Due to this, some potential buyers of homes are being priced out of the market, and others are unsure about the best time to make a purchase. But there is no indication that the increase in borrowing costs will soon stop.

Mortgage rates are increasing as a result of the financial market volatility and economic uncertainty. Senior Economist and Manager of Economic Research at realtor.com, George Ratiu, states the following:

“While even two months ago rates above 7% may have seemed unthinkable, at the current pace, we can expect rates to surpass that level in the next three months.”

So, is now the right time to buy a home? Anyone thinking about buying a home today should ask themselves two questions:

1. Where Do I Think Home Prices Are Heading?

For an answer to this query, there are two directions to look. The majority opinion among specialists comes first. If you look at the predictions made by experts for home price growth in 2023, it will likely be around 2%. While it's true that some predict a decline in property values during the coming year, the majority predicts an increase.

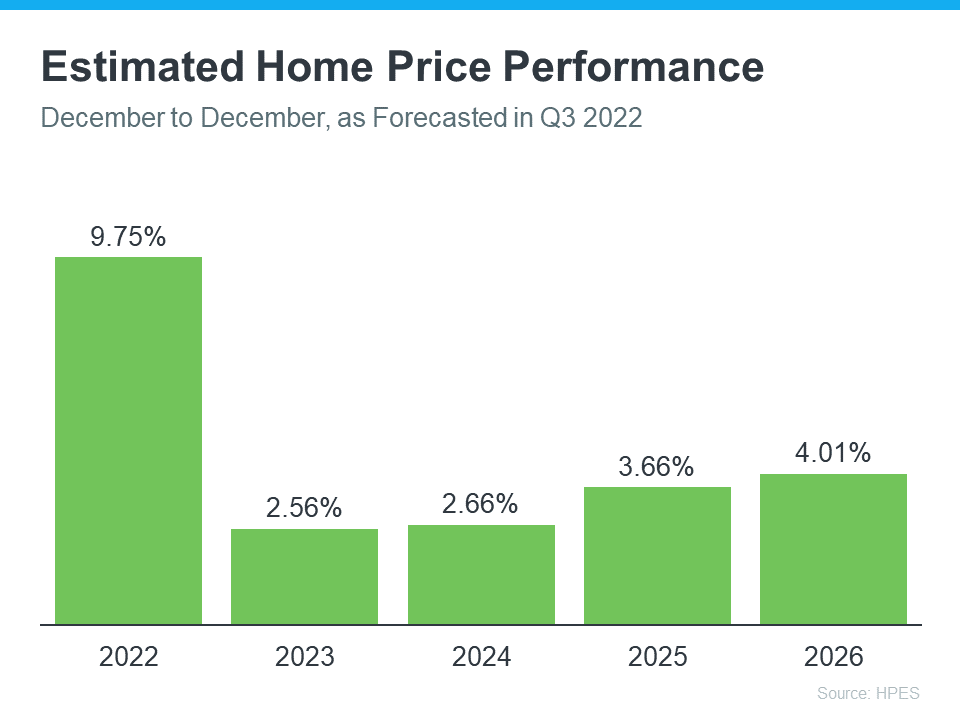

The Home Price Expectation Poll from Pulsenomics, a survey of a national panel of over one hundred economists, real estate specialists, and investment and market strategists, is the second place to look for information. The most recent report states that the experts questioned anticipate housing prices to rise over the coming years (see graph below):

2. Where Do I Think Interest Rates Are Heading?

Ratiu anticipates an increase in mortgage rates over the coming months, as was already announced. Another specialist concurs. Chief Economist at First American, Mark Fleming, says:

“While mortgage rates are expected to continue to drift higher over the coming months, much of the rapid increase in rates is likely behind us.”

This erratic market is being driven by global uncertainty and increased inflation, which is raising borrowing costs for homebuyers.

Bottom Line

If you're considering purchasing a property, knowing the current market value and mortgage rates can enable you to make an informed choice. Experts anticipate increased costs and rates in the future. Renting is an option, but rents are rising as well. That can imply that owning a home is a better option than renting.